Life Insurance

What is the purpose of life insurance?

- Your funeral expenses

- The notary and executor of your will

- Taxes on death: at this point, the bulk of your assets are presumed sold and tax may thus be payable. Conversely, the amount of the life insurance paid by the insurer is always tax-free.

- Your debts (credit cards, mortgage, personal loans, etc.)

- Your children’s education

- Savings strategy

Bear in mind that should you die, the amount of your insurance must be sufficient for your beneficiaries to maintain the same standard of living. The insurance premiums should suit your budget. Since there are several types of insurance, there is certainly one that meets your needs.

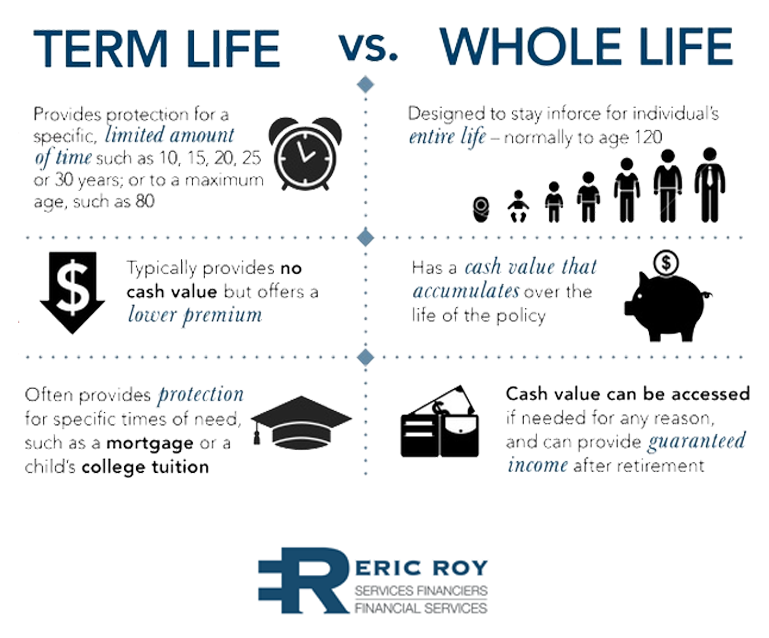

Term Life

- This insurance provides protection for a limited period, for example 5, 10 or 20 years. Term life insurance is usually renewable at prices that increase from period to period.

- To be able to repay the balance of a loan

- To provide financial support to children as long as

- they are dependents of the parents

- To provide support to the surviving spouse

- To be used for company share buyouts

Term life insurance is used for temporary insurance needs in case of death, for example, in order for the insurance amount:

Participating Life or Whole Life

- This insurance remains in force until the death of the insured, and is used in particular by people who wish to leave an inheritance. If you retain this product, you are certain that the insurer will eventually pay the stipulated insurance amount.

- Are looking for lifetime protection with a tax-advantaged savings component

- Are interested in innovative ways to save for retirement or to more effectively meet their estate planning needs

- Want to increase their death benefit over time to keep pace with inflation.

- Increase their after-tax investment returns, especially in a low limited-income environment (GICs, bonds).

Insurance covering ongoing needs in general includes cash surrender values. The cash surrender value is the amount that you receive on terminating your insurance. It is sometimes possible to borrow on this cash surrender value as a financial strategy, without terminating the insurance.

Participating life insurance offers permanent life insurance protection (whole life insurance) and the tax-advantaged growth potential of the cash surrender value. The base insurance is guaranteed for life, as long as you pay the premiums on time.

The policy is also eligible for dividends, which you can use to get additional insurance, receive a cash payment or reduce your annual premium. You can also let them accumulate to generate interest.

This type of insurance is an excellent solution for people who:

Universal Life

You can choose to invest the sums among several types of investments. The accumulated amount can be used to pay the cost of insurance. You can also access your money through withdrawals or loans.